(CBOE: FRNS)

Coolabah Short Term Income Active ETF (CBOE: FRNS)

Daily Liquidity, Short Duration, Tradable on CBOE Australia

Overview

The Coolabah Short Term Income Active ETF (CBOE: FRNS) harnesses CCI’s extensive management team to actively exploit mispricings in cash and bond markets to generate daily liquidity returns that exceed a target of the RBA cash rate plus 1.5% to 3.0% pa after all fees with an average A credit rating and near-zero interest rate duration risk.

It is a daily liquidity solution that invests in cash and fixed-income assets that are hedged to a floating-rate (ie, not fixed-rate) exposure that means it has near-zero interest rate (duration) risk.

It cannot use leverage. It is typically placed in the “short duration fixed-interest” (credit) or “cash-enhanced” universes.

The Coolabah Short Term Income Active ETF is a class of the Coolabah Short Term Income Fund which is quoted on the Cboe Australia securities exchange and accessible under the ticker FRNS.

Information on the unlisted Coolabah Short Term Income Fund – Assisted Investor Class (APIR: SLT0052AU) can be viewed here.

Investments

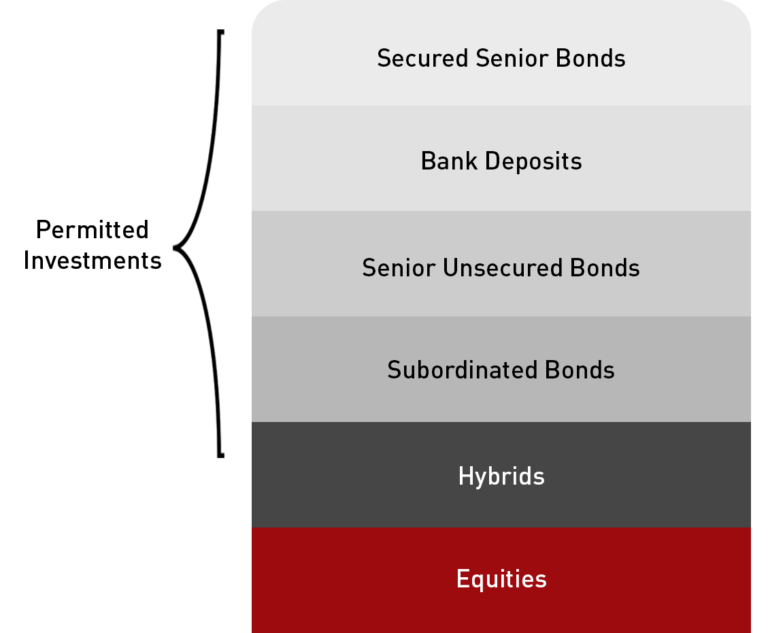

FRNS actively invests in a portfolio of Australian cash securities and bonds with a target dollar-weighted average credit rating in the “A” band.

All fixed-income assets are hedged to a floating-rate (ie, not fixed-rate) exposure that means it has near-zero interest rate (duration) risk.

FRNS does not invest in fixed-rate bonds (unless interest rate risk is hedged out) or equities, and is not permitted to use leverage.

Applying a diverse array of quantitative asset pricing techniques, FRNS’s portfolio managers add-value through exploiting bond mispricings that seek to generate capital gains over and above the yield provided by the underlying fixed-income assets.

Risks

The Fund is not a bank deposit.

It is a managed investment scheme registered and regulated by the Australian Securities and Investments Commission (ASIC).

All investments carry risks, including that the value of investments may vary, future returns may differ from past returns, and that your capital is not guaranteed.

To understand the Fund’s risks better, please refer to the detailed “Risks” section in the PDS and to the Fund’s Target Market Determination (TMD)^.

The Coolabah Short Term Income Active ETF (CBOE: FRNS) harnesses CCI’s extensive management team to actively exploit mispricings in cash and bond markets to generate daily liquidity returns that exceed a target of the RBA cash rate plus 1.5% to 3.0% pa after all fees with an average A credit rating and near-zero interest rate duration risk.

It is a daily liquidity solution that invests in cash and fixed-income assets that are hedged to a floating-rate (ie, not fixed-rate) exposure that means it has near-zero interest rate (duration) risk.

It cannot use leverage. It is typically placed in the “short duration fixed-interest” (credit) or “cash-enhanced” universes.

The Coolabah Short Term Income Active ETF is a class of the Coolabah Short Term Income Fund which is quoted on the Cboe Australia securities exchange accessible under the ticker FRNS.

Information on the unlisted Coolabah Short Term Income Fund – Assisted Investor Class (APIR: SLT0052AU) can be viewed here.

FRNS actively invests in a portfolio of Australian cash securities and bonds with a target dollar-weighted average credit rating in the “A” band.

All fixed-income assets are hedged to a floating-rate (ie, not fixed-rate) exposure that means it has near-zero interest rate (duration) risk.

FRNS does not invest in fixed-rate bonds (unless interest rate risk is hedged out) or equities, and is not permitted to use leverage.

Applying a diverse array of quantitative asset pricing techniques, FRNS’s portfolio managers add-value through exploiting bond mispricings that seek to generate capital gains over and above the yield provided by the underlying fixed-income assets.

The Fund is not a bank deposit.

It is a managed investment scheme registered and regulated by the Australian Securities and Investments Commission (ASIC).

All investments carry risks, including that the value of investments may vary, future returns may differ from past returns, and that your capital is not guaranteed.

To understand the Fund’s risks better, please refer to the detailed “Risks” section in the PDS and to the Fund’s Target Market Determination (TMD)^.

Key Facts

| Name | Coolabah Short Term Income Active ETF |

| Exchange Ticker | FRNS |

| Exchange | Cboe Australia (CXA) |

| ISIN | AU0000294662 |

| Investment Objective | Targets returns in excess of the RBA cash rate plus 1.5% to 3.0% p.a. after management fees and costs over a rolling 12 month period |

| Class Inception Date | 14-Sep-23 |

| Fund Inception Date | 08-Oct-14 |

| Management Costs | 0.69% |

| Performance Fee (%) | 22.5% of excess fund outperformance over the Benchmark subject to a high water mark. |

| Benchmark | RBA cash rate (RBACOR) plus 1.5% plus Management Costs |

| Distribution Frequency | Quarterly |

| Distribution Reinvestment Plan (DRP) | Full or partial participation available. |

| Issuer & Responsible Entity | Equity Trustees |

| Investment Manager | Coolabah Capital Investments (Retail) |

| Fund Administrator | Apex Fund Services |

| Registry | Apex Fund Services |

| Custodian | Citigroup |

| Auditor | Ersnt & Young |

Pricing Information

An indicative NAV per Unit (“iNAV”) will be published by the Fund throughout the Trading Day. The iNAV will be updated using a real time fair value methodology that seeks to ensure that the iNAV reflects movements in markets and currencies during the Trading Day.

The iNAV represents the best estimate by the Responsible Entity or its appointed agents of the value per unit in the Fund throughout the trading day. No assurance can be given that the iNAV will be published continuously or that it will be up to date or free from error. To the extent permitted by law, neither the Responsible Entity nor its appointed agent shall be liable to any person who relies on the iNAV. The price at which Units trade on the Securities Exchange may not reflect the NAV per Unit or the iNAV and may differ from the price received when applying for or redeeming with the Responsible Entity. Please refer to the Product Disclosure Statement for further details on this Risk.

| NAV/Unit (Interim)* | $30.2342 |

| Net Assets* ($AUD) | $69,595,960 |

| Units Outstanding * (#) | 2,302,371 |

| NAV/Unit (Final)* | $30.2280 |

| ARSN | 601 093 485 |

| Exchange Code | FRNS |

| ISIN | AU0000294662 |

| Tradable | On Cboe Australia (CXA) |

| Bloomberg Code | FRNS AU |

| Bloomberg iNAV Code | FRNSAUIV |

Performance

| Period Ending 2025-11-30 | Gross Return | Net Return | RBA Cash Rate | Gross Excess Return | Net Excess Return |

|---|---|---|---|---|---|

| 1 month | 0.31% | 0.25% | 0.27% | 0.04% | -0.02% |

| 3 months | 1.22% | 1.04% | 0.89% | 0.33% | 0.15% |

| 6 months | 2.84% | 2.44% | 1.83% | 1.02% | 0.62% |

| 1 year | 5.66% | 4.79% | 3.93% | 1.73% | 0.86% |

| Inception pa 14 Sep. 2023 | 6.39% | 5.49% | 4.14% | 2.26% | 1.36% |

Coolabah Short Term Income Fund – Assisted Investor Class SLT0052AU

| Period Ending 2025-12-31 | Gross Return (Assist.) | Net Return (Assist.) | RBA Cash Rate | Gross Excess Return | Net Excess Return (Assist.) |

|---|---|---|---|---|---|

| 1 month | 0.44% | 0.38% | 0.32% | 0.12% | 0.06% |

| 3 months | 1.15% | 0.97% | 0.90% | 0.25% | 0.07% |

| 6 months | 2.85% | 2.44% | 1.83% | 1.02% | 0.62% |

| 1 year | 5.44% | 4.59% | 3.88% | 1.57% | 0.72% |

| 3 years pa | 6.53% | 5.56% | 4.02% | 2.51% | 1.54% |

| 5 years pa | 4.28% | 3.41% | 2.65% | 1.63% | 0.76% |

| 10 years pa | 4.24% | 3.28% | 1.94% | 2.31% | 1.34% |

| Inception pa Oct. 2014 | 4.20% | 3.24% | 1.96% | 2.24% | 1.27% |

The above table shows the returns of the Coolabah Short Term Income Fund – Assisted Investor Class SLT0052AU since its inception on 8 October 2014. SLT0052AU is an equivalent class of the same Fund with identical management fees and costs. Past performance does not assure future returns. Returns for periods longer than one year are annualised.

The above chart shows the returns of the Coolabah Short Term Income Fund – Assisted Investor Class SLT0052AU since its inception on 8 October 2014. SLT0052AU is an equivalent class of the same Fund with identical management fees and costs. Past performance does not assure future returns. Returns are calculated in Australian dollars using net asset value per unit at the start and end of the specified period and do not reflect brokerage or the bid ask spread that investors incur when buying and selling units on the Securities Exchange. Returns are after all fund costs, assume reinvestment of any distributions and do not take into account tax paid as an investor in the Fund.

Asset Allocation

Distributions

| Qtr Ending | Ex Date | Record Date | Payment Date | Distribution Unit ($) | DRP Price |

|---|---|---|---|---|---|

| 31-Dec-2025 | 02-Jan-26 | 05-Jan-26 | 21-Jan-26 | 0.36 | 30.0743 |

| 30-Sep-2025 | 01-Oct-25 | 02-Oct-25 | 17-Oct-25 | 0.33 | 30.1387 |

| 30-Jun-2025 | 01-Jul-25 | 02-Jul-25 | 18-Jul-25 | 0.37 | 30.0319 |

| 31-Mar-2025 | 01-Apr-25 | 02-Apr-25 | 17-Apr-25 | 0.36 | 30.0774 |

| 31-Dec-2024 | 02-Jan-25 | 03-Jan-25 | 21-Jan-25 | 0.42 | 30.1341 |

| 30-Sep-2024 | 01-Oct-24 | 03-Oct-24 | 18-Oct-24 | 0.42 | 30.1039 |

| 30-Jun-2024 | 01-Jul-24 | 02-Jul-24 | 18-Jul-24 | 0.5914 | 30.1236 |

| 31-Mar-2024 | 02-Apr-24 | 03-Apr-24 | 17-Apr-24 | 0.435 | 30.2321 |

| 31-Dec-2023 | 02-Jan-24 | 03-Jan-24 | 18-Jan-24 | 0.36 | 30.2349 |

Disclaimer: Past performance does not assure future returns. Returns are shown after all fund fees, unless otherwise stated. Retail product fees can vary depending on the unit class selected and/or whether the financial advisory firm has negotiated access to lower cost unit classes.

Equity Trustees Limited (Equity Trustees) ABN 46 004 031 298 AFSL 240975, is the Responsible Entity for the Australian domiciled funds. Equity Trustees is a subsidiary of EQT Holdings Limited ABN 22 607 797 615, a publicly listed company on the Australian Securities Exchange (ASX: EQT).

This has been prepared by Coolabah Capital Investments (Retail) Pty Ltd ACN 153 555 867 (Coolabah), an authorised representative (#000414337) of Coolabah Capital Institutional Investments Pty Ltd ABN 85 605 806 059 AFSL 482238, to provide you with general information only. In preparing this publication, we did not take into account the investment objectives, financial situation or particular needs of any particular person. It is not intended to take the place of professional advice and you should not take action on specific issues in reliance on this information. The Product Disclosure Statement (PDS) for the Fund should be considered before deciding whether to acquire or hold units in it. A PDS for the Fund can be obtained by visiting www.stag.coolabahcapital.com. Neither Coolabah, Equity Trustees nor any of their related parties, their employees or directors, provide any warranty of accuracy or reliability in relation to such information or accepts any liability to any person who relies on it. Past performance should not be taken as an indicator of future performance. The Fund is subject to investment risks, which could include delays in repayment and/or loss of income and capital invested.

^From 5 October 2021, a Target Market Determination (TMD) is required to be made available under the Design & Distribution Obligations. It describes who this financial product is likely to be appropriate for (i.e. the target market), and any conditions around how the product can be distributed to investors. It also describes the events or circumstances where the Target Market Determination for this financial product may need to be reviewed.

The Fund was previously known as the Smarter Money Higher Income Fund ARSN 601 093 485. On 5 September 2023, it was renamed to the Coolabah Short Term

Income Fund to coincide with the launch of the quoted “(Managed Fund)” Class (CXA: FRNS). The investment strategy, objectives and terms remain unchanged.

- THE FUNDS

- Performance

- ETFs

- Coolabah Short Term Income Active ETF (CBOE: FRNS)

- Coolabah Global Floating-Rate High Yield Complex ETF (CBOE: YLDX)

- Coolabah Global Carbon Leaders Complex ETF (CBOE: CBNX)

- Coolabah Active Composite Bond Complex ETF (CBOE: FIXD)

- Betashares Australian Hybrids Active Fund (ASX: HBRD)

- MANAGED FUNDS

- Smarter Money Fund

- Coolabah Short Term Income Fund

- Coolabah Floating-Rate High Yield Fund

- Coolabah Global Floating-Rate High Yield Fund

- Coolabah Global Carbon Leaders Fund

- Smarter Money Long-Short Credit Fund

- Coolabah Long-Short Opportunities Fund

- Coolabah Active Composite Bond Complex ETF

- Coolabah Active Global Bond Fund

- Coolabah Active Sovereign Bond Strategy

- USD Strategies