Coolabah Active GLOBAL Bond Strategy

Coolabah Active Global Bond Fund

Daily Liquidity, Long Duration, Global Strategy

Overview

The Coolabah Active Global Bond Fund targets returns in excess of the Bloomberg Global Aggregate Corporate Index (hedged to AUD) after management costs, by 1.0% to 2.0% per annum over rolling 3 year periods.

The Fund offers an active fixed-income strategy focused on mispricing in corporate bond markets with the aim of delivering superior risk-adjusted returns. The Fund has the ability to go long and short credit to profit from declining and increasing credit spreads.

The Fund offers fixed-rate bond exposure by matching its interest rate duration to that of the Index.

Coolabah adds-value by finding and exploiting bond mispricings in high grade credit markets that can generate capital gains or alpha in addition to the yield on these securities.

To find these mispricings, you need a very large team coupled with significant quantitative resources, which is why we have over 47 executives, across Sydney, Melbourne, London and Auckland. It is also why we have built up to 40-50 proprietary quant valuation models in house and harnessed AI to help us in our search for mispricings.

Exploiting these mispricings to generate capital gains also requires a very active investment style. We are typically trading 50 to 100 times a day, on average $250-500 million per day.

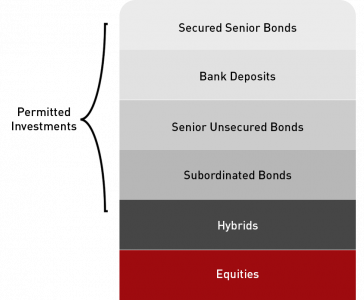

Investments

The Coolabah Active Global Bond Fund provides exposure to a diversified portfolio of cash securities and bonds, including government bonds, bank bonds, corporate bonds, asset-backed securities including residential-mortgage backed securities, and hybrid securities issued in G10 currencies hedged back to AUD, with an average target credit rating of A. It cannot invest in equities, property, unrated securities, high yield bonds or sub-prime loans.

Applying a diverse array of quantitative asset pricing techniques, the portfolio managers add-value through very actively exploiting bond mispricings that seek to generate capital gains over and above the yield provided by the underlying fixed-income assets.

Risks

The Fund is not a bank deposit.

It is a managed investment scheme registered and regulated by the Australian Securities and Investments Commission (ASIC).

All investments carry risks, including that the value of investments may vary, future returns may differ from past returns, and that your capital is not guaranteed, which can be amplified by the use of leverage.

To understand the Fund’s risks better, please refer to the detailed “Risks” section in the PDS and to the Fund’s Target Market Determination (TMD)^.

Ratings

Qualitative

The Coolabah Active Global Bond Fund targets returns in excess of the Bloomberg Global Aggregate Corporate Index (hedged to AUD) after management costs, by 1.0% to 2.0% per annum over rolling 3 year periods.

The Fund offers an active fixed-income strategy focused on mispricing in corporate bond markets with the aim of delivering superior risk-adjusted returns. The Fund has the ability to go long and short credit to profit from declining and increasing credit spreads.

The Fund offers fixed-rate bond exposure by matching its interest rate duration to that of the Index.

Coolabah adds-value by finding and exploiting bond mispricings in high grade credit markets that can generate capital gains or alpha in addition to the yield on these securities.

To find these mispricings, you need a very large team coupled with significant quantitative resources, which is why we have over 47 executives, across Sydney, Melbourne, London and Auckland. It is also why we have built up to 40-50 proprietary quant valuation models in house and harnessed AI to help us in our search for mispricings.

Exploiting these mispricings to generate capital gains also requires a very active investment style. We are typically trading 50 to 100 times a day, on average $250-500 million per day.

The Coolabah Active Global Bond Fund provides exposure to a diversified portfolio of cash securities and bonds, including government bonds, bank bonds, corporate bonds, asset-backed securities including residential-mortgage backed securities, and hybrid securities issued in G10 currencies hedged back to AUD, with an average target credit rating of A. It cannot invest in equities, property, unrated securities, high yield bonds or sub-prime loans.

Applying a diverse array of quantitative asset pricing techniques, the portfolio managers add-value through very actively exploiting bond mispricings that seek to generate capital gains over and above the yield provided by the underlying fixed-income assets.

The Fund is not a bank deposit.

It is a managed investment scheme registered and regulated by the Australian Securities and Investments Commission (ASIC).

All investments carry risks, including that the value of investments may vary, future returns may differ from past returns, and that your capital is not guaranteed, which can be amplified by the use of leverage.

To understand the Fund’s risks better, please refer to the detailed “Risks” section in the PDS and to the Fund’s Target Market Determination (TMD)^.

Key Facts

| Name | Coolabah Active Global Bond Fund |

|---|---|

| ARSN | 676 577 670 |

| Inception Date | 23-Sep-2024 |

| Applications | Daily |

| Withdrawals | Daily (T+3) |

| Distribution Frequency | Quarterly |

| Distribution Method | Reinvestment or paid out available |

| Issuer & Responsible Entity | Equity Trustees |

| Investment Manager | Coolabah Capital Investments (Retail) |

| Fund Administrator | Apex Fund Services |

| Registry | Apex Fund Services |

| Custodian | Citigroup |

| Auditor | Ernst & Young |

Pricing Information

| Class | Assisted Investor Class |

|---|---|

| APIR Code | ETL2586AU |

| ISIN | AU60ETL25862 |

| Tradable | Directly with the Responsible Entity |

| Investment Objective | Targets returns in excess of the Bloomberg Global Aggregate Corporate Index (hedged to AUD) plus 1.0% to 2.0% after Management Costs |

| Management Costs | 0.65% p.a. |

| Performance Fee (%) | 20.5% of excess fund performance over the Benchmark after Management Costs subject to a high water mark |

| Benchmark | Bloomberg Global Aggregate Corporate Index (hedged to AUD) |

| Minimum Investment | $1,000 |

| Additional Investment | $1,000 |

| Minimum Balance | $1,000 |

| Buy Spread | 0.000% |

| Sell Spread* | 0.025% |

Distributions

Distribution Per Unit ($)

| Quarter Ending | Assisted Investor Class | Institutional Class |

|---|---|---|

| APIR Code | ETL2586AU | ETL1382AU |

| 31-Dec-25 | 1.940750 | 2.871586 |

| 30-Sep-25 | - | 0.014080069410 |

| 30-Jun-25 | - | - |

| 31-Mar-25 | - | 0.00322613 |

Platform Availability

| Platform | Assisted Investor Class |

|---|---|

| APIR Code | ETL2586AU |

| ASX/Cboe | No |

| AMP North | No |

| Australian Money Market | No |

| Beacon | No |

| BT Asgard | No |

| BT Panorama | No |

| Credit Suisse | No |

| Crestone | No |

| Diversa | No |

| FirstWrap | No |

| Hub24 | No |

| IOOF Expand | No |

| Key Invest | No |

| Macquarie Wrap | No |

| Mason Stevens | No |

| MLC Expand | No |

| Morgan Stanley | No |

| Netwealth | No |

| OneVue | No |

| Perpetual WealthFocus | No |

| Powerwrap | No |

| Praemium | Yes |

| UBS | No |

| uXchange | No |

| Wilsons Advisory | No |

Resources

Key Documents

Research Reports

Frequently Asked Questions

To invest via the responsible entity – You can apply online here.

Complete a withdrawal request form and submit it to the responsible entity (RE). Further instructions are on the form.

^From 5 October 2021, a Target Market Determination (TMD) is required to be made available under the Design & Distribution Obligations. It describes who this financial product is likely to be appropriate for (i.e. the target market), and any conditions around how the product can be distributed to investors. It also describes the events or circumstances where the Target Market Determination for this financial product may need to be reviewed.

Disclaimer: Past performance does not assure future returns. Returns are shown after all fund fees, unless otherwise stated. Retail product fees can vary depending on the unit class selected and/or whether the financial advisory firm has negotiated access to lower cost unit classes.

Equity Trustees Limited (Equity Trustees) ABN 46 004 031 298 AFSL 240975, is the responsible entity for the Fund. Equity Trustees is a subsidiary of EQT Holdings Limited ABN 22 607 797 615, a publicly listed company on the Australian Securities Exchange (ASX: EQT).

This has been prepared by Coolabah Capital Investments (Retail) Pty Ltd ACN 153 555 867 (Coolabah), an authorised representative (#000414337) of Coolabah Capital Institutional Investments Pty Ltd ABN 85 605 806 059 AFSL 482238, to provide you with general information only. In preparing this publication, we did not take into account the investment objectives, financial situation or particular needs of any particular person. It is not intended to take the place of professional advice and you should not take action on specific issues in reliance on this information. The Product Disclosure Statement (PDS) for the Fund should be considered before deciding whether to acquire or hold units in it. A PDS for the Fund can be obtained by visiting www.stag.coolabahcapital.com. Neither Coolabah, Equity Trustees nor any of their related parties, their employees or directors, provide any warranty of accuracy or reliability in relation to such information or accepts any liability to any person who relies on it. Past performance should not be taken as an indicator of future performance. The Fund is subject to investment risks, which could include delays in repayment and/or loss of income and capital invested.

Ratings & Research Disclaimers

Zenith Investment Partners

The Zenith Investment Partners (ABN 27 103 132 672, AFS Licence 226872) (“Zenith”) rating (assigned ETL2586AU May 2025) referred to in this piece is limited to “General Advice” (s766B Corporations Act 2001) for Wholesale clients only. This advice has been prepared without taking into account the objectives, financial situation or needs of any individual, including target markets of financial products, where applicable, and is subject to change at any time without prior notice. It is not a specific recommendation to purchase, sell or hold the relevant product(s). Investors should seek independent financial advice before making an investment decision and should consider the appropriateness of this advice in light of their own objectives, financial situation and needs. Investors should obtain a copy of, and consider the PDS or offer document before making any decision and refer to the full Zenith Product Assessment available on the Zenith website. Past performance is not an indication of future performance. Zenith usually charges the product issuer, fund manager or related party to conduct Product Assessments. Full details regarding Zenith’s methodology, ratings definitions and regulatory compliance are available on our Product Assessments and at Fund Research Regulatory Guidelines.

- THE FUNDS

- Performance

- ETFs

- Coolabah Short Term Income Active ETF (CBOE: FRNS)

- Coolabah Global Floating-Rate High Yield Complex ETF (CBOE: YLDX)

- Coolabah Global Carbon Leaders Complex ETF (CBOE: CBNX)

- Coolabah Active Composite Bond Complex ETF (CBOE: FIXD)

- Betashares Australian Hybrids Active Fund (ASX: HBRD)

- MANAGED FUNDS

- Smarter Money Fund

- Coolabah Short Term Income Fund

- Coolabah Floating-Rate High Yield Fund

- Coolabah Global Floating-Rate High Yield Fund

- Coolabah Global Carbon Leaders Fund

- Smarter Money Long-Short Credit Fund

- Coolabah Long-Short Opportunities Fund

- Coolabah Active Composite Bond Complex ETF

- Coolabah Active Global Bond Fund

- Coolabah Active Sovereign Bond Strategy

- USD Strategies