This is an article portfolio manager Christopher Joye published on Livewire recently.

On the subject of the search for yield, one question I am regularly asked is whether retail investors should be switching from major bank hybrids, which have performed exceptionally well over the last 12 months, into the tsunami of high-yield listed investment trusts (LITs) that have been raising large amounts of money by paying brokers and advisers huge conflicted sales commissions of up to 2 per cent to 3 per cent of the capital they source from naïve retail and wholesale investors.

Major bank hybrids have a BB+ credit rating, which puts them just below the cusp of the so-called investment grade band that runs from BBB to AAA. The new high-yield bond LITs often invest in US and European BB and B rated bonds or direct loans that have no rating at all.

Five-year major bank hybrid credit spreads are paying about 2.7 per cent above the quarterly bank bill swap rate (BBSW). In the US, lower-rated BB high-yield bond credit spreads are trading at a lesser 2.4 per cent above the equivalent “Libor” benchmark.

So, on a like-for-like basis, US high-yield securities offer inferior returns. We are further forecasting that Standard & Poor’s will upgrade the major banks’ hybrids into the BBB- category where the average five-year credit spread is about 1.7 per cent above BBSW (or 100 basis points lower than what you get on major bank hybrids).

Given the recent hybrid rally, I have also been asked whether now is a good time to take profits. Well, yes, it might be. But not to switch into foreign high yield. The reduction in credit spreads on both major bank hybrids and BB rated US debt has been almost identical since their respective “wides” in late 2018.

There are other complications. One thing we avoid like the plague is buying high-yield debt from corporates with much higher internal business model risk than you get with large Aussie banks and insurers. Everyone knows the $143 billion bank CBA with its world-beating AA- credit rating. This presents a striking contrast with the largest exposure in one recent ASX LIT, the Brazilian oil company Petrobas, which carries a junk or high-yield credit rating of just BB-, some nine notches below CBA. I would personally much rather buy a BB+ rated security issued by CBA than a similarly rated instrument from Petrobas given the radically lower business risks the big Australian bank carries (as reflected in its vastly superior issuer rating).

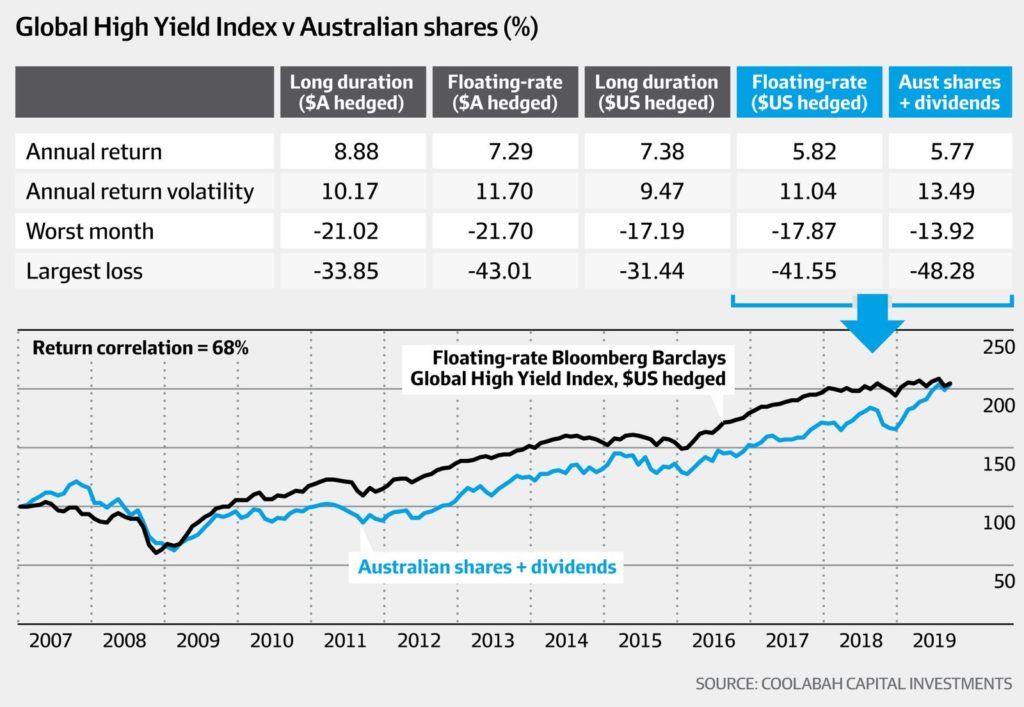

Another problem is hedging costs. You used to be able to improve your total returns materially by hedging US fixed income into Aussie dollars –nowadays doing so reduces your returns by more than 1 per cent annually because the RBA’s cash rate is below, not above, the US Federal Reserve’s cash rate. This unattractive risk and return trade-off is compounded by LITs’ fees, which often add up to more than 1 per cent annually.

The LITs deal with this panoply of problems in three ways. First, they invest in even riskier bonds with much lower credit ratings than hybrids. Second, some assume larger interest-rate “duration risk” by allocating to fixed-rate bonds which, all else being equal, are far more volatile than similarly rated floating-rate hybrids. This means that in addition to credit risk, investors are adding on another source of capital loss, which is changes in long-term interest-rate expectations.

A third return driver is leverage. The two most recent LITs have allowed themselves to use leverage of between 30 per cent and 50 per cent of the capital raised from mums and dads. One might counter that leveraging illiquid junk bonds issued by companies investors know nothing about is a recipe for disaster.

A final consideration is relative value. Major bank hybrids are paying credit spreads that are about 2.7 times higher than they were before the global financial crisis in 2007 despite the fact that the major banks have more than halved the risk-weighted leverage on their balance sheets. In contrast, BB rated bonds in the US are trading on credit spreads that are lower than their mid 2007 levels, while corporate leverage has been increasing, not decreasing